Key Cost Considerations for Small Business Owners

Evaluating Initial Expenses

Understanding Start-Up Costs

When starting a small business, it is crucial to identify and understand your start-up costs. These costs often include expenses for equipment, inventory, and initial marketing efforts. Other considerations include legal fees and any necessary permits or licenses. By thoroughly evaluating these expenses, business owners can create a more accurate budget.

Creating a detailed list of start-up costs helps in defining the capital required before opening doors. This list can prevent unexpected financial strains that could arise during early operations. Additionally, seeking advice from industry experts can provide insights into hidden costs.

Small business owners should also consider recurring costs that may not be evident initially. For instance, expenses related to utilities, rent, and employee salaries must be included in the financial planning. Understanding both start-up and recurring costs enables better financial forecasting for the business.

Investing time in careful assessment of start-up costs can lead to smarter spending decisions. Beyond just listing costs, business owners should prioritize spending based on immediate needs and long-term goals.

Effective planning about initial expenses can make a significant difference in the sustainability of a business. Financial clarity from the outset paves the way for growth and adaptation as the business evolves.

Contingency Planning

Contingency planning is an essential aspect of financial strategy for small business owners. In a dynamic market, unexpected expenses can arise at any moment. Having a financial cushion set aside can prevent these costs from derailing the business's operations. A good rule of thumb is to allocate a portion of the budget to cover unforeseen expenses.

Business owners should regularly review and adjust their financial plans to reflect changing circumstances. This includes keeping track of variable costs that can fluctuate based on market conditions. Adjusting budgets frequently allows for more agility in responding to financial challenges.

Moreover, establishing an emergency fund can provide peace of mind for owners and stakeholders alike. This fund can be a lifeline during slow periods or unexpected downturns. Knowing that resources are available can lead to more confident decision-making.

Engaging with financial advisors and accountants can also enhance preparation for potential contingencies. Their insights can help identify risks and suggest appropriate measures to mitigate them. Investing in good financial advice is critical for long-term stability.

In conclusion, contingency planning should not be an afterthought. Proper financial preparation and adaptability can safeguard a business against unpredictable challenges over time.

Operating Costs and Their Impact

Understanding Fixed and Variable Costs

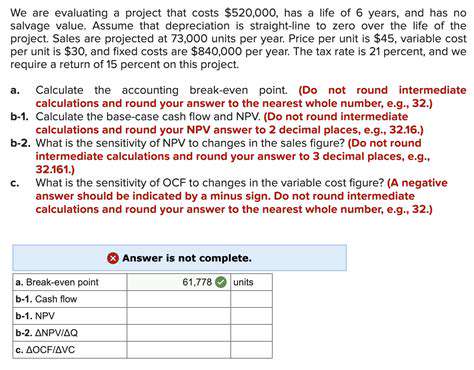

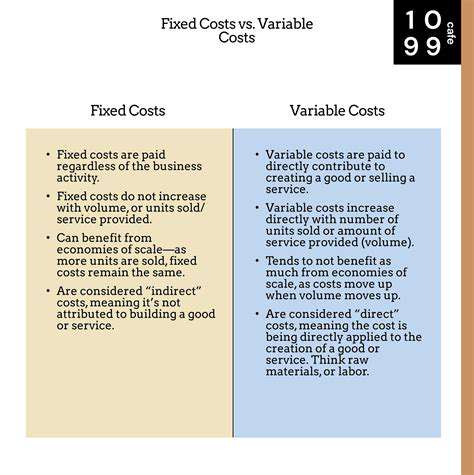

For small business owners, it's crucial to distinguish between fixed and variable costs. Fixed costs remain constant regardless of production levels, such as rent, salaries, and insurance. Knowing these expenses helps in forecasting budgets and understanding the minimum revenue required to break even.

On the other hand, variable costs fluctuate with business activity, including raw materials, utilities, and commission for sales staff. Managing these costs effectively can enhance profitability but requires careful tracking and analytical skills.

By analyzing both types of costs, small business owners can identify potential areas for savings, optimize pricing strategies, and improve overall financial health. Understanding these cost structures informs better decision-making and strategic planning.

Additionally, implementing software tools for cost tracking can provide insights into spending patterns, helping owners to make informed decisions based on comprehensive data analysis.

The Role of Cash Flow Management

Effective cash flow management is vital for small business sustainability. It ensures that a business has enough liquidity to meet its obligations as they come due. Owners should regularly monitor cash inflows and outflows to identify potential shortages or surpluses early.

Implementing strategies such as invoicing promptly, negotiating favorable payment terms with suppliers, and maintaining a cash reserve can significantly improve cash flow. Small businesses may also consider using financial forecasting to predict future cash needs and identify potential shortfalls before they arise.

Moreover, understanding seasonality and its impact on cash flow can help owners prepare for periods of lower revenue, ensuring that the business remains on solid footing regardless of market conditions.

By prioritizing cash flow management, small business owners not only secure their operations but also position their businesses for growth, enabling them to invest in new opportunities when they arise.

Variable vs. Fixed Costs

Understanding Fixed Costs

Fixed costs are expenses that do not change with the level of goods or services produced by a business. These costs remain constant regardless of sales volume, making them predictable and easier to budget for small business owners. Examples of fixed costs include rent, salaries, and insurance premiums.

For small businesses, understanding fixed costs is crucial because they represent a baseline for the financial health of the company. If fixed costs are too high relative to revenues, it can lead to financial strain. Therefore, managing these costs effectively can be key to a business's long-term sustainability.

In evaluating fixed costs, small business owners should consider ways to optimize their expenditures. This might include negotiating lease terms or finding more cost-effective insurance providers. Overall, continuous review of fixed costs can help in maximizing profitability.

Exploring Variable Costs

Variable costs, unlike fixed costs, fluctuate with the business activity level. These costs increase as production levels rise and decrease when production falls. Common examples include raw materials, commission-based wages, and utilities.

For a small business, understanding variable costs is essential for pricing strategies and overall financial planning. If variable costs are not monitored carefully, they can lead to unpredictable cash flow issues. Effectively managing these costs can allow businesses to respond swiftly to changes in demand.

A successful approach to managing variable costs often involves regular analysis and adjustments based on production levels. Small business owners can implement strategies such as bulk purchasing and building relationships with suppliers to negotiate better pricing. This proactive management can significantly affect profitability.

Impact of Cost Structure on Pricing Strategies

The structure of fixed and variable costs has a direct impact on pricing strategies for small businesses. Understanding the cost structure enables business owners to price their products or services competitively while still covering expenses. Failing to account for costs in pricing can lead to losses and unsustainable business practices.

When small businesses analyze their costs, they can determine the minimum price needed to cover expenses before making a profit. This is particularly crucial in competitive markets where pricing plays a significant role in customer decision-making. Setting prices too low can erode profit margins, while prices set too high may drive customers away.

In conclusion, small business owners must carefully consider their pricing strategies based on a comprehensive understanding of both fixed and variable costs. A well-informed pricing strategy can enhance competitiveness and ensure long-term business viability. Regular evaluations and adjustments to pricing will help adapt to market changes effectively.

Strategies for Managing Costs Effectively

Managing costs effectively is a cornerstone of financial stability for small businesses. Implementing cost-control measures can help ensure that both fixed and variable costs are kept in check. Some common strategies include streamlining operations and renegotiating contracts with suppliers.

Small business owners can also benefit from adopting technology solutions that automate processes and reduce labor costs. For instance, using accounting software can minimize the time spent on bookkeeping, enabling owners to focus on core business functions. In addition, regular training for employees on cost-saving practices can lead to more efficient operations.

Finally, developing a budget and conducting regular financial reviews will allow small business owners to identify areas where costs can be further reduced. By continuously monitoring expenses, businesses can remain agile and responsive to economic changes. This proactive approach to cost management ensures the longevity and success of the business.

Importance of Budgeting

Understanding Financial Health

For small business owners, a clear understanding of financial health is crucial. Proper budgeting allows you to track income and expenses, ensuring that you're making informed decisions about your business operations. Without a thorough grasp of your financial status, it's easy to overlook potential problems before they escalate.

Moreover, evaluating financial health regularly helps in identifying trends and patterns in your business. This can lead to better forecasting and planning, enabling owners to set realistic goals and budgets for the future.

Strategic Cost Management

Strategic cost management involves analyzing costs to determine where expenses can be minimized without sacrificing quality. By reviewing and adjusting expenses, small businesses can improve their profit margins significantly. Utilizing tools like cost-benefit analysis can help owners decide where to invest their limited resources for maximum impact.

Engaging in regular financial reviews empowers business owners to make proactive changes. This strategic approach not only helps in managing current expenditures but also in preparing for potential future challenges.

Long-Term Cost Considerations in Business Growth

Understanding Operating Expenses

Operating expenses are the ongoing costs for running a business, such as rent, utilities, and salaries. For small business owners, careful tracking of these expenses is vital for maintaining financial health. Regularly reviewing operating costs can highlight areas where savings can be made or where expenditures may need to increase for growth opportunities.

Additionally, small businesses should consider variable versus fixed operating expenses. Variable costs can fluctuate with sales, offering some flexibility, while fixed costs require consistent financial commitment. Understanding the balance between these types of expenses can help owners manage cash flow effectively.

Investment in Technology

Investments in technology can lead to significant long-term savings and efficiencies for small businesses. Upgrading software and hardware can automate processes, streamline operations, and improve customer service. However, it is essential for owners to evaluate the return on investment (ROI) of technology expenditures.

Moreover, with the rise of cloud computing, small businesses can access sophisticated tools without the high costs of traditional infrastructure. As such, understanding the nuances of tech investments can help business owners make informed choices that balance upfront costs against future gains.

Employee Compensation and Benefits

Compensation and benefits are major costs for small businesses, but they are also critical for attracting and retaining talent. While salary is important, offering a comprehensive benefits package can be a powerful incentive for employees. This could include health insurance, retirement plans, and flexible work arrangements.

It’s essential for small business owners to compare their compensation packages with industry standards to remain competitive. Additionally, regularly assessing employee satisfaction can provide insights into whether current compensation aligns with employee expectations and market trends.

Marketing and Customer Acquisition Costs

Marketing is essential for growth, but it can also represent a significant portion of a small business's budget. Understanding customer acquisition cost (CAC) is crucial; this metric helps owners evaluate the effectiveness of marketing strategies. Investing in digital marketing and social media can sometimes yield higher engagement at lower costs compared to traditional advertising.

Moreover, business owners should monitor the lifetime value of customers (LTV) in relation to CAC. This understanding will enable them to allocate their marketing budget more effectively and ensure efforts are contributing to the bottom line.

Long-Term Debt Management

Debt management is a key cost consideration for small businesses, especially those looking to expand. While taking on debt can provide necessary capital for growth, it's important for owners to have a clear plan for repayment. High-interest debt can quickly become a liability, so understanding terms and potential risks is essential.

Small business owners should consider various financing options, such as loans, lines of credit, or even grants. Each option has its own implications for cash flow and long-term financial strategy, making it crucial for owners to choose the best fit for their situation.